Portfolio diversification formula

The fundamental purpose of portfolio diversification is to minimize the risk on your investments. Ad Parametric crafts every solution to be unique to your clients goals.

Investment Analysis And Portfolio Management Lecture 3 Gareth Myles Ppt Download

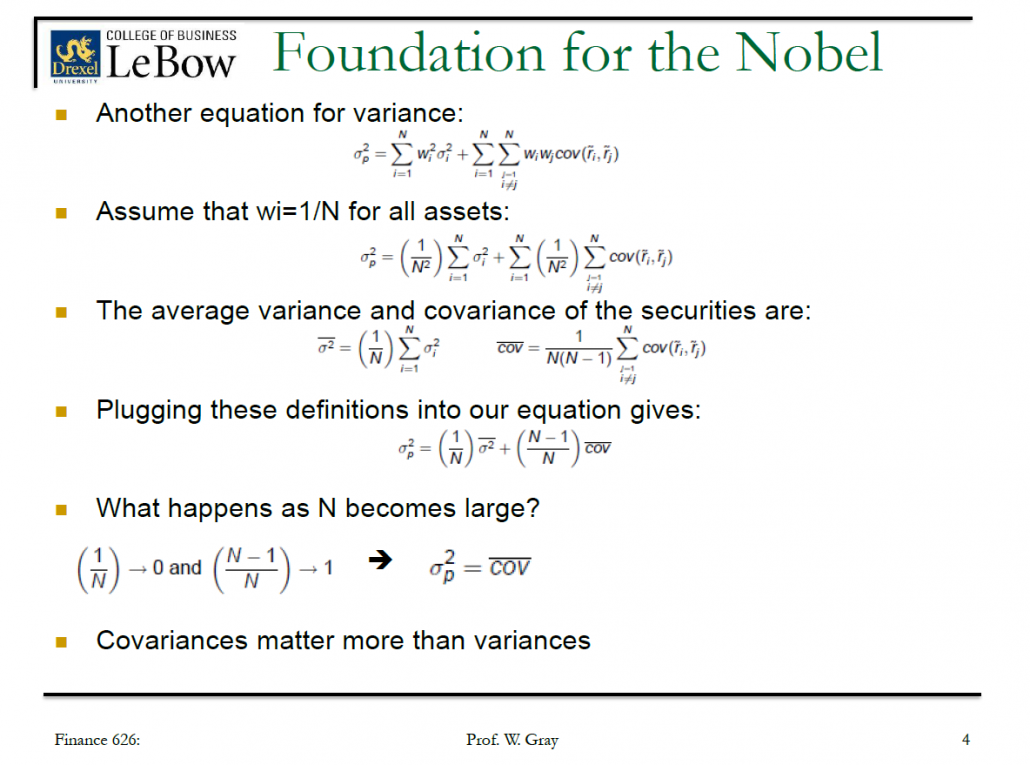

The formula for portfolio variance is given as.

. This is your one stop shop. One-on-One Portfolio Construction and Diversification Resources for a Balanced Portfolio. Ad Download this must-read guide about retirement income from Fisher Investments.

Ad Capital Groups Portfolio Construction Approach Can Help You Pursue Clients Goals. Ad Help Your Clients Reach Their Goals W One Of Our Top Performing Funds. One-on-One Portfolio Construction and Diversification Resources for a Balanced Portfolio.

Financial Planning is complicated let us simplify it for you. The rationale behind this technique contends that a portfolio. With a concentra-tion ratio of 50 the example portfolio has the.

I have written many times. Ad Help Your Clients Reach Their Goals W One Of Our Top Performing Funds. Make passive investing personal.

Portfolio diversification is one of the most useful skills of a professional investor since the goal of diversification is reduction of the portfolio risks while preserving the yield. The expected return on Z is 10 and the expected return on Y is 3. A Fund With Unexpected Upside In Undervalued Companies Traded At Discounted Values.

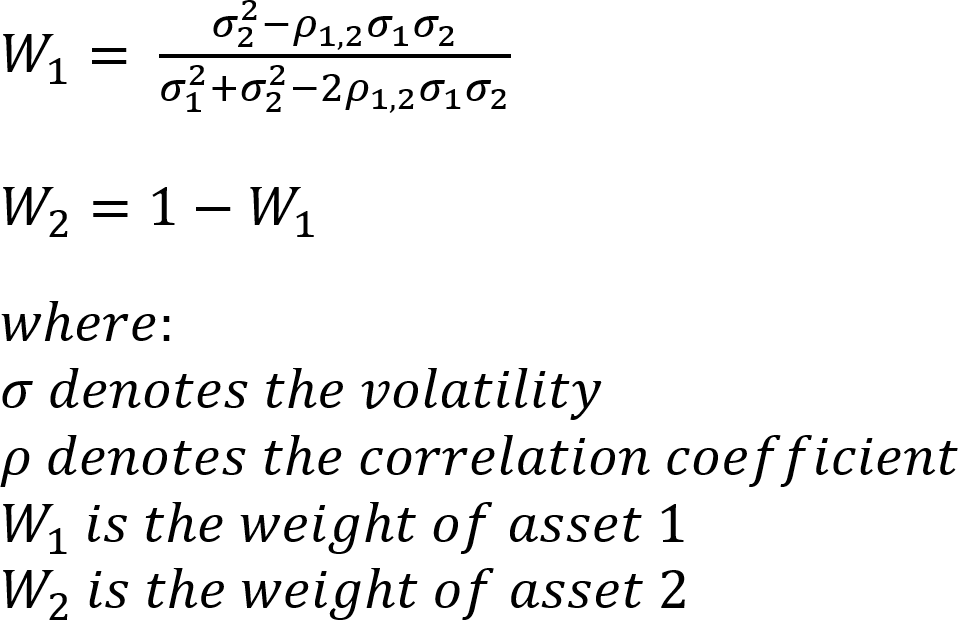

But for simplicitys sake lets assume a two-asset portfolio in which case the formula is this. Portfolio diversification or selecting a diverse group of assets to limit risks while increasing possible returns is a solid rule of thumb. Formula for Portfolio Variance.

Too many stocks and you run the risk of a very expensive index fund. The Diversification Quotient If the portfolio consists of N loans of equal size then the concentration ratio is 1N. Here are five tips for helping you with diversification.

Consider an investor holds a portfolio with 4000 invested in Asset Z and 1000 invested in Asset Y. Var Rp w21Var R1 w22Var R2 2w1w2Cov R1 R2 Where Cov R1 R2 represents the covariance of the two asset. The variance for a portfolio consisting of two assets is calculated using the following formula.

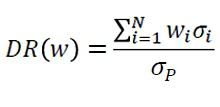

As the number of assets grows we get the asymptotic formula. For years many financial advisors recommended building a 6040 portfolio allocating 60 of capital to stocks. W i the weight of the ith asset.

Thus the goodsindifference curve is given by u cH α cF. Thus in an equally weighted portfolio the portfolio variance tends to the average of covariances between securities as the. Ad Download this must-read guide about retirement income from Fisher Investments.

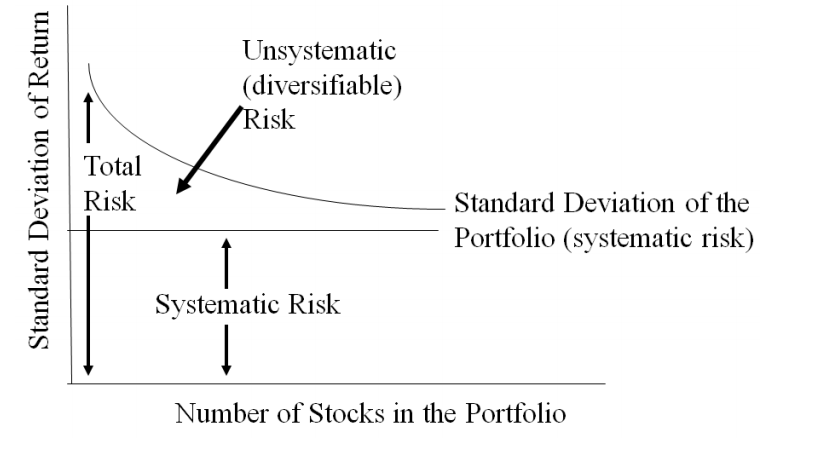

MPT shows that by combining more assets in a portfolio diversification is increased while the standard. Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. The Factors that Drive Asset Returns and the Efficiency of Diversification.

INVESTMENT PRINCIPLES - Information Sheet for CFA Professionals In this example the required rate of. A solid investment portfolio often contains. Achieving Optimal Diversification to Reduce Unsystematic Risk.

Purpose of portfolio diversification. A diversified portfolio should have a broad mix of investments. Equities can be wonderful but dont put all of your money in one stock or one sector.

Ad Capital Groups Portfolio Construction Approach Can Help You Pursue Clients Goals. Financial Planning is complicated let us simplify it for you. This is your one stop shop.

A Fund With Unexpected Upside In Undervalued Companies Traded At Discounted Values. The weight of one asset multiplied by its return plus. Domestic consumers utility function is given by u cH α cF α where cj α denotes state α consumption of good j j H F.

Too few stocks and one blowup hurts the portfolio by a noticeable amount.

Time Diversification Redux Research Affiliates

:max_bytes(150000):strip_icc()/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

Portfolio Diversification How To Diversify Your Investment Portfolio

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Standard Deviation And Variance Of A Portfolio Finance Train

Portfolio Diversification How To Diversify Your Investment Portfolio

Solactive Diversification The Power Of Bonds

The Portfolio Diversification Effect Youtube

Finance Portfolio Variance Explanation For Equation Investments By Zvi Bodie Quantitative Finance Stack Exchange

How Many Stocks Make Up A Well Diversified Portfolio Seeking Alpha

Modern Portfolio Theory 2 0 The Most Diversified Portfolio Seeking Alpha

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Chapter 5 Risk And Rates Of Return N

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Portfolio Returns And Risks Covariance And The Coefficient Of Correlation

Div61 Gif